ATHÉNA & Forbes Contributor Interviews: Luxury Fashion Redefined, Futuristic Shopping Experience & Fashion M&A

An interview from Sep 2020 –

“Where Entertainment Happens, Shopping Follows…”

Forbes Contributor Richard Kestenbaum believes the next evolution in retail is when people come for entertainment not shopping, but they end up spending and buying: “Think about ‘The Las Vegas Model’. Retail should focus on experience first: create a unique facility where the majority of the space is for entertainment and there are many forms of entertainment, including theme park for children.”

Kestenbaum covers topics in retail, fashion, consumer insights and has been an investment banker for over 35 years focusing on M&A deals for the retail and consumer goods industry. He has sold popular online fashion shopping site Shopbop to Amazon. He also appears regularly in print and other media as well as industry panels and speaking programs. Kestenbaum received his MBA with a concentration in Finance from Harvard University.

When I heard Richard would like to ruminate together about what is happening in the industry since I seem thoughtful about where the industry is going, I found out Richard is doing some interesting things and there are a bit of common interest topics as well.

Therefore following a cordial interview by Richard last July on future of retail, digital fashion, disruptive trends post-pandemic, I am excited to invite Richard back for an interview to discuss further on interesting topics in fashion M&A, COVID impact, futuristic shopping experience and trends.

Last July I have expressed the following views with Kestenbaum about the industry:

- The Isolated Industry: Fashion industry is lagging so behind and isolated in terms of mindset, digital and technology.

- “From Destructive to Disruptive”: COVID-19, while being destructive, is also the initiator of things disruptive that we’ll soon start seeing in the industry and the entire world. Brands and retailers are starting to realize the importance of ecommerce, digital marketing and virtual technologies. They are putting effort into enhancing their digital capabilities.

- The ‘Future’ is Delayed: Futuristic technologies and concepts, while fascinating, hasn’t really gone anywhere after all the years.

- International Fashion Markets Recovery: There are differences in terms of world economy recovery. It might make sense for companies to focus on markets that will recover sooner and quicker.

Below Kestenbaum shares his visions and insights in the future of fashion, retail, mergers and acquisitions –

Athena: As Coronavirus reshapes the retail M&A market, how will some of the acquisitions you anticipate to look like in the fashion/luxury industry, by category of the company (brands, retailers, online brands, department stores, major brand management groups, cross industries), if not names?

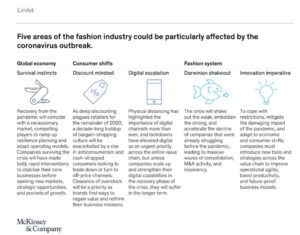

Kestenbaum: As the result of COVID-19 and the shutdowns, two trends are surging:

Legacy brands which fail to adapt to ever changing consumer needs, wants and demands will go bankruptcy. Acquisitions can help maximize the left over value of an older brand and create a new configuration.

Secondly, transactions that wouldn’t happen before is now making better sense as online grocery is exploding and consumers have changed the way they purchase the basics over the past few months thanks to the pandemic.

For example, Kroger should merge with Albertson’s to compete with Walmart and Amazon in online grocery. Walmart should buy Walgreen samely due to online grocery shopping growth plus increased consumers’ interest in health and wellness.nWalmart can use Walgreens facilities for staging of fast delivery and pickup of small grocery orders.

In terms of trending categories of acquisitions, the types of buyers haven’t changed; ultimately the motivation stays the same: growth, opportunity and profit.

Photo Credit: Triangle Capital LLC

Athena: Do traditional fashion houses such as Chanel or Prada that have remained separate from the luxury conglomerates such as LVMH and Kering have advantages from this separation or they would benefit from being acquired?

Kestenbaum: It is a trade off. There are pros and cons for each. Being on your own is easier and faster when it comes to allocate resources. Whereas being part of a big entity grants more resources and renders less risks.

The decision to acquire depends on the evaluation of risks and the company’s character. Join a large entity can crash the entrepreneurial culture of a company; but it can also enable it to grow.

Athena: Yes Chanel remained independent because they want to preserve their traditional values while also have much freedom when it comes to decision making.

Athena: Chanel’s tradition and value are worth preserving through maintaining its independence. Things however also change over time and the question of what is the right fit, goals and resources may turn in a different answer for the direction it should be heading toward.

Athena: Right just like the forever question of when high end luxury brands will go Ecommerce and sell expensive bags and clothing online. Can you tell us more about the Shopbop -> Amazon and Hudson Jeans -> Joe’s Jeans deals? How and in what ways has your company gotten involved? What is your opinion in regards to an all-encompassing online store Amazon acquiring a luxury fashion e-tailer?

Kestenbaum: I have more in depth involvement with the Shopbop deal than the Hudson Jeans deal. For the latter, all we did was to render fairness opinion; and advise Joe’s Jeans board whether it is a good buy or not.

For the former, Amazon approached Shopbop for a potential buy. Shopbop also wanted to sell as they are growing so fast that they are afraid to not be able to manage such kind of growth. Shopbop has brought us in to negotiate the deal with Amazon. It was a great sell and we have helped Shopbop increase its valuation by 45% for the deal. Shopbop has been doing an amazing job since the sale. Amazon has let Shopbop remain independent in how they operate and run their business. It is a smart move for Amazon.

Athena: Yes they did the same with Zappos. According to Zappos’ Tony Hsieh, he sold Zappos to Amazon because Jeff Bezos assured Hsieh that Zappos could operate independantly and retain its remarkable culture. What is your opinion in regards to an all-encompassing online store Amazon acquiring a luxury fashion e-tailer?

Kestenbaum: I personally don’t think Amazon is the right platform for luxury fashion. We have yet to see how it pans out.

There are multiple reports that Amazon is launching a luxury fashion site. Amazon may be the best system in the world for providing consumers with a way to shop when they know what they want and are looking for fast and convenient service. But the luxury fashion business is different. It requires exploration, discovery, personal service and creativity to be effective. Buying Fruit of the Loom underwear is not the same as buying an occasion dress from Oscar de la Renta. It is not as easy for Amazon to add luxury to its portfolio as it is to add another type of toothpaste.

Amazon is near impossible to beat on selection and convenience. But whether they can succeed in luxury fashion, and whether they are good for their possible luxury vendors, is an open question.

Athena: I have learned about the American Dream Mall in New Jersey from you. I think it is a great concept and believed in the model before COVID-19. However in a post COVID world with unprecedented acceptance of virtual technology and experience, do you think we still need such a gigantic space for full entertainment and retail shopping?

Kestenbaum: I think the future of retail is where people come out for fun and entertainment. They didn’t know or think they will buy yet being in that environment where entertainment and retail co-exist, they ended up buying and shopping. Just look at Las Vegas – it is a town created as a destination of entertainment, and then naturally shopping.

Retail should focus on experience first: create a unique facility where the majority of the space is for entertainment. There are many forms of entertainment, including theme park for children.

What drives consumers into stores isn’t buying things; it’s the fun and exploration they can have and what they can experience with friends. Malls can’t go back to what they were—consumers don’t want that anymore.

Such an entertainment and experience focused approach for retail is the future and even a small retail store on the Fifth Avenue can offer such experience its customers. Whether the space dedicated to this experience should be smaller or bigger is hard to say. But the need for such experience is certain.

American Dream Mall

Athena: Would luxury fashion revive after the pandemic or we are going to see a surge of more essential fashion wear business?

Kestenbaum: Luxury has been redefined in the last few years. We used to define luxury as fashion made out of the highest quality of material and sold to customers with the highest customer service.

Fashion is expressing who you are and your status. Yet nowadays people doesn’t care as much about status as it used to be. Luxury is defined based on each’s own perception and personal experience. For someone who has very little personal time, if he goes hiking and enjoys it, a great pair of hiking shorts is luxury for him.

Athena: I have seen some cool future technology of China videos about their power in robotics, artificial intelligence, supercomputing, bullet trains, aeronautics and other fields. Do you think China is ahead in terms of “futuristic technologies”?

Kestenbaum: No I think US is the lead. Innovation and creativity comes from US. China can’t do this.

Athena: While this is true, I see that China takes what US did and make it better. Look at Weibo and WeChat.

Kestenbaum: China is driven by a top down design economy. The central authority of government can accumulate power and create something of magnitude. On the other hand capitalism is about efficient allocation of capitals.

Futuristic Cinema

Athena: What are some of the key future trends you see for the fashion and retail industry?

Kestenbaum: One of the key things I think is important is content. Brands want two things:

- Increase their margin

- Reduce customer acquisition cost

Everyone rushes to Direct-to-Consumer, yet you need an unique voice to reach to consumers directly in a more efficient way. Facebook and Instagram are smart as they have built the content platforms for everyone to use.

Look at Glossier, they started as a blog, built an audience and then start creating a brand with products. It is the paradigm,

where the fashion and retail industry is going, whereas it used to be about advertising.

It is also about values in life. Understand the values of people who created the company and convey the value with content. When consumers resonate with the value and identify the content, they are less interested in buying by discount. Pricing is no longer the key bargain.

Recent Comments